Our advantages

- Trustworthy corporate services agents, business immigration lawyers and immigration solicitors for corporate customers and private persons

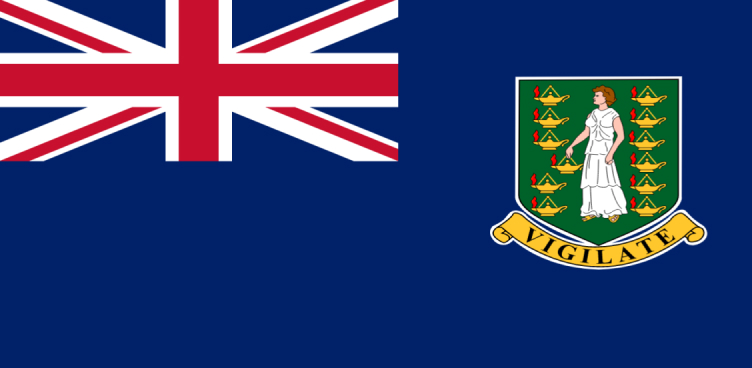

- Tax efficient jurisdictions and countries to form an offshore company, register or relocate a business

- Complete solutions for corporate clients and private entrepreneurs looking for advantageous business environment or user-friendly legislation

- Remote offshore incorporation. Quickly and in full compliance with local legislation. No travel required.

- Solutions for persons looking to immigrate or obtain a work visa, residence permit in a new place

- Solutions for international traders conducting business worldwide using international business company incorporated offshore

Only reliable corporate services agents and immigration lawyers